Crypto Exchange Wars: How Coinbase Stacks Up Against Its Rivals

Coinbase is among the hundreds of cryptocurrency exchanges that have sought to fill a gap left by the mainstream, for years offering investors the only platforms for investing in Bitcoin and other tokens. However the industry has matured, and the mainstream is warming up to crypto, making the exchange business hotly contested and challenging leaders like Coinbase.

Coinbase is among the hundreds of cryptocurrency exchanges that have sought to fill a gap left by the mainstream, for years offering investors the only platforms for investing in Bitcoin and other tokens. However the industry has matured, and the mainstream is warming up to crypto, making the exchange business hotly contested and challenging leaders like Coinbase.

Michael J. McDonald

Michael J. McDonald is an award-winning journalist who has worked at Bloomberg News and Thomson Financial. He is a Senior Writer at Toptal.

Expertise

Coinbase’s direct listing in April was a watershed moment, putting crypto firmly in the mainstream. It also gave the trading platform an advantage in an industry that aims to reinvent financial services, from stock trading to settlements. Still, the game is early, and Coinbase could turn out to be another Netscape, the internet browser sensation whose share offering helped spark the dot-com stock frenzy in the 1990s only to be crushed by the incumbent, Microsoft’s Internet Explorer.

“Right now, they have the name in the industry,” says Lambert Despaux, a Toptal freelance private markets expert and the founder of venture capital firm Schema Capital. “But the competition is going to be fierce.”

Coinbase is one of the hundreds of cryptocurrency exchanges launched since Bitcoin was introduced in 2009, offering investors an alternative platform to buy and sell digital coins that until recently were not available on conventional trading sites. Wall Street may have left the lane wide open for the new industry to develop but the establishment has been warming up to the asset class: Bitcoin reached new highs this year, topping $63,000 in April, and other coins and digital assets have seen buying frenzies.

JPMorgan Chase, for one, is preparing to unveil an actively managed Bitcoin fund, four years after chairman and CEO Jamie Dimon called the cryptocurrency “dangerous” and threatened to fire any of his traders if they touched it. Trading in CME Group’s crypto futures, launched in 2017, has surged. Money manager Grayscale Investments has seen assets soar in its trusts that give investors indirect exposure to crypto. The Securities and Exchange Commission has fielded multiple applications to approve crypto exchange-traded funds, something European regulators have permitted.

Still, the cryptocurrency exchange business remains the domain of upstarts like Coinbase and its rivals. We took a look at the biggest and best-known players and found that while, at their core, they share some fundamental similarities in the technology they use, there are vast differences in terms of quality and security, with geography and regulation playing significant roles in those differences.

How the Largest Crypto Exchanges Ensure Safety (or Don’t)

Around 7,000 cryptocurrencies have been launched through initial coin offerings since 2009, though Bitcoin and Ethereum still account for more than half of trading volumes on global exchanges. Because many digital coins are thinly traded and regulation is so uneven, some spot exchange trading can be manipulated by market players, known as whales, that have significant funds and can move prices, as well as by pump-and-dump schemes, says Sandesh Hegde, a Toptal freelance corporate finance expert based in Mumbai.

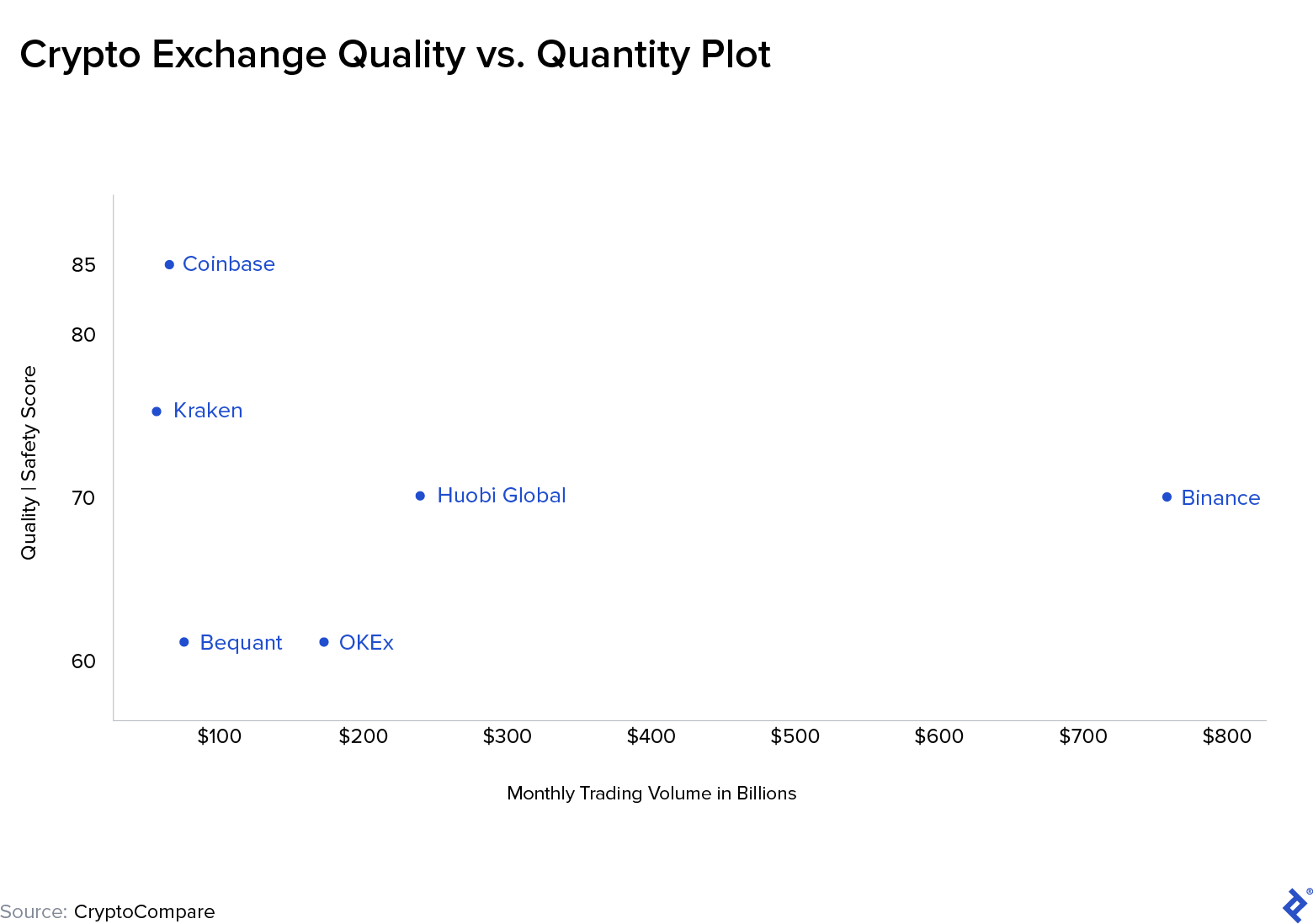

CryptoCompare ranks the exchanges, looking at factors like how much of a customer’s crypto assets are stored in cold wallets, which are disconnected from the internet and so can’t be hacked, and what kinds of funds or insurance are in place if hacks occur. It also attempts to measure the quality of a platform’s data and pricing, as well as the effectiveness of monitoring programs in place to prevent things like money laundering, a perennial headache for the industry.

Coinbase earns the highest rating in the analysis and is followed by other US and European crypto exchanges that were established in the years following the emergence of Bitcoin and have been meeting stricter regulatory standards. These include New York-based Gemini, which was founded by the Winklevoss twins of Facebook lore; London-based Bitstamp; and San Francisco-based Kraken.

All four exchanges are certainly significant players and well-known names in the business. But the largest by far is Binance, a company launched just four years ago in China that has grown explosively, offering more than 350 coins and generating spot trading volume of $757 billion in March, about 10 times more than Coinbase, according to a report from CryptoCompare.

“There’s always an upstart that could easily emerge as the next new thing,” says Clara Medalie, Strategy Lead at Kaiko, a market data provider for the digital assets industry. “It’s very difficult to predict.”

While Binance is ranked lower than Coinbase for quality and safety, it is widely seen as the most innovative, for instance unveiling one of the industry’s first crypto derivatives platforms for more sophisticated traders. The company relocated operations offshore in 2018 after China cracked down on crypto but it has run afoul of regulators in some other jurisdictions and was forced to offer a stripped-down version of its online trading portal in the US.

The biggest exchanges have avoided the kind of spectacular hacking attacks that plagued the business since Mt. Gox, the first major platform, collapsed in 2014 after many of its digital coins were plundered. Binance survived a hack in 2019 when $40 million was stolen from accounts. The company covered the losses using a fund it set up for such situations. Because of the volatility of crypto prices, insurance for exchange accounts is still limited, though cash balances at companies like Coinbase do qualify for coverage from the Federal Deposit Insurance Corp.

Competitive Field: Security vs. Volume

More than half the trading tracked by CryptoCompare is conducted on exchanges launched in Asia, making the region a contender as the industry’s center of gravity. One of the other largest crypto platforms is Huobi Global, which was also founded in China but moved its headquarters offshore to the Seychelles. Huobi offers investors almost as many coins as Binance, 325 compared with 358, but doesn’t attract the same amount of traffic, posting trading volumes of about $210 billion in March versus $757 billion for the market leader.

Coinbase complained about its offshore rivals in its securities filing before it went public in April, citing that its “commitment to compliance … ha[s] resulted in our customers transferring significant funds and crypto assets to unregulated or less regulated competitors.” Still, its reputation gives it an advantage as crypto invades financial markets with tokenized versions of products like stocks and bonds, as well as other regulated industries in which US institutions are established leaders.

“That’s the interesting thing,” says Hudson Cashdan, a Toptal freelance blockchain expert, and former trader and hedge fund equity analyst. “Which is the winning strategy? Is it the Wild West? Or do you want to play the long game within the existing regulatory structure, which is what Coinbase is doing?”

Coinbase made its name as the safest on-ramp for converting dollars into tokens and developed a brokerage business that attracted not just retail but a growing cadre of corporate clients like Tesla and hedge fund Third Point Management. While it lags rivals in trading volume, it still has the most assets under management on its platform, a $223 billion pool of liquidity that gives it power to provide superior pricing and trade execution that institutional investors demand, says Zachary Elfman, a Toptal freelance finance expert.

How Coinbase Makes Money

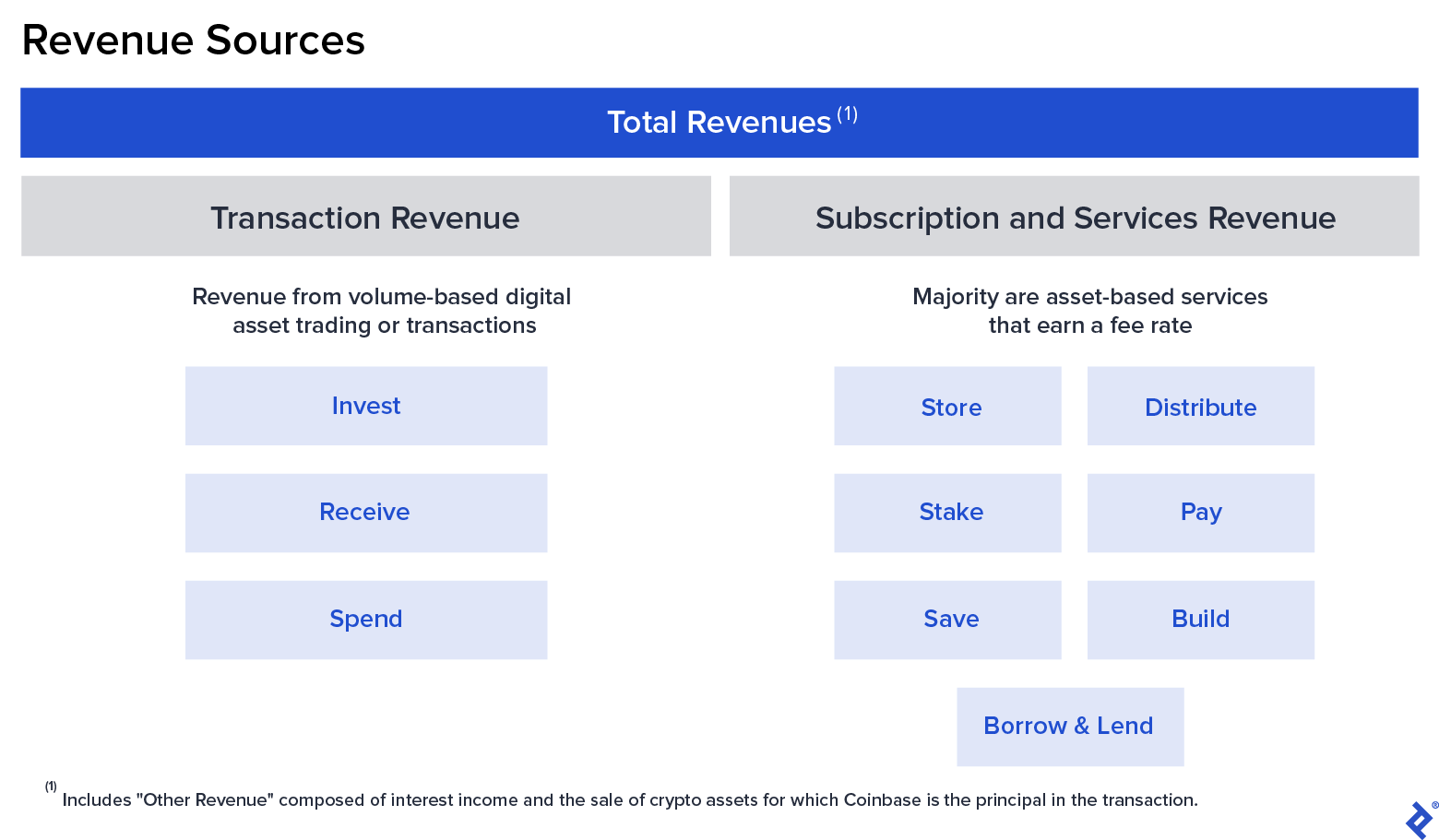

The trading fees investors pay when they convert their fiat currencies into crypto, as well as when they trade coins on platforms, are the primary source of revenue for exchanges. The breadth of services and markets is also growing with more margin trading, leverage, and derivatives on some platforms. In that sense the exchanges are not unlike established stock trading sites like Charles Schwab, in that they largely count on transactions for much of their revenue.

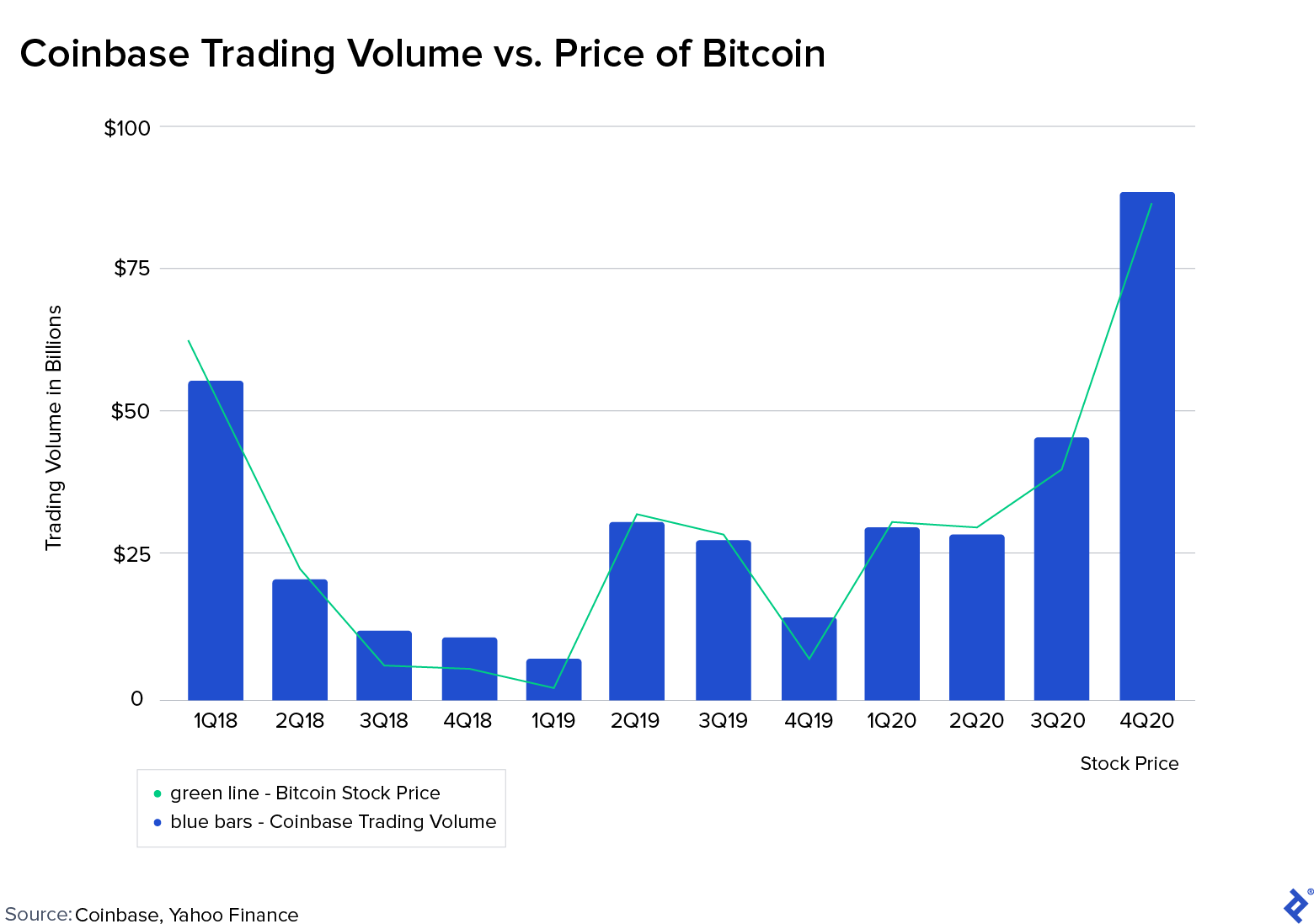

Volumes for crypto exchanges are, unsurprisingly, heavily influenced by the price volatility of cryptocurrencies. Currently the largest influence remains Bitcoin. Coinbase’s total trading volumes nearly doubled in the fourth quarter last year, growing to $89 billion versus $46 billion the prior three months. This mirrors Bitcoin, which almost tripled in price in those three months. Coinbase is rapidly expanding the number of coins it supports as it believes this will provide some level of stability from diversification.

Coinbase gets most of its revenue from transactions, with retail investors paying trading fees as high as 4%, while institutional investors, which trade in higher volumes, paid under 10 basis points on average last year. This compares to competitor Binance’s fee of about 0.1% and to a traditional brokerage like Charles Schwab that increasingly charges nothing for online stock trades. Currently, Coinbase believes it has pricing power as it provides integrated secure asset storage and fraud prevention. Nevertheless, fees may need to compress as brokerages like Robinhood Financial expand into crypto markets.

The company’s other sources of revenue, subscription and services, include products like custodial services for institutional investors. While this portion of Coinbase’s revenue is currently not very meaningful at just $45 million on $1.3 billion of total revenue, it is growing rapidly, up 126% year over year in 2020, albeit at a lower rate versus transaction revenue, as total revenue was up 139%. These services are part of Coinbase’s strategy to appeal to those who value security and proper adherence to regulations.

How the industry develops from here is anybody’s guess. In a matter of weeks this year, India proposed banning cryptocurrencies completely, while the Chinese government launched its own centrally controlled digital token. Crypto purists are now flocking to so-called decentralized exchanges, an alternative that promises the kind of trading anonymity that has so often run afoul of regulators. Coinbase’s expertise in navigating evolving regulatory regimes should be an advantage and it has backers like Marc Andreessen, the co-founder of Netscape, to help it identify the threats incumbents pose.

“Strategically they’ve been very savvy,” says Lewis Fellas, who founded the crypto hedge fund Bletchley Park Asset Management. “They’re focused on being good at the things they’re really good at.”

Further Reading on the Toptal Blog:

- Investing in Cryptocurrencies: The Ultimate Guide

- Exploring the Post-crash Cryptocurrency Market: Blockchain, Regulations, and Beyond

- What Is Bitcoin Mining? How It Works and What It Takes to Make It Pay

- The Benefits of Formosa Crypto Wallet Management

- Time-locked Wallets: An Introduction to Ethereum Smart Contracts

- Esports: A Guide to Competitive Video Gaming