Exploring the Post-crash Cryptocurrency Market: Blockchain, Regulations, and Beyond

The 2022 crash shook the cryptocurrency market to its core, but investors are still buying digital coins. How does crypto work, and what does the future hold for it?

Jeffrey Mazer

Digital Ledgers vs. Databases: Can Blockchain Optimize Your Supply Chain?

Blockchain isn’t just for cryptocurrency. The technology can also be used to make supply chain management more efficient, transparent, and secure. Here’s how.

Neil Mann

What Is Bitcoin Mining? How It Works and What It Takes to Make It Pay

Bitcoin mining is still strong in North America, sparking new revenue opportunities for companies with access to cheap power, especially renewables. Learn about the risks as well as the rewards.

Dhruv Tandan

How Companies Are Building Digital Asset and NFT Strategies

Despite crypto volatility, major brands are continuing to invest in NFTs. It’s time for more companies—not just those with valuable, recognizable IP—to explore how to create NFT strategies of their own.

Brian Nichol

Crypto Exchange Wars: How Coinbase Stacks Up Against Its Rivals

Coinbase is among the hundreds of cryptocurrency exchanges that have sought to fill a gap left by the mainstream, for years offering investors the only platforms for investing in Bitcoin and other tokens. However the industry has matured, and the mainstream is warming up to crypto, making the exchange business hotly contested and challenging leaders like Coinbase.

Michael J. McDonald

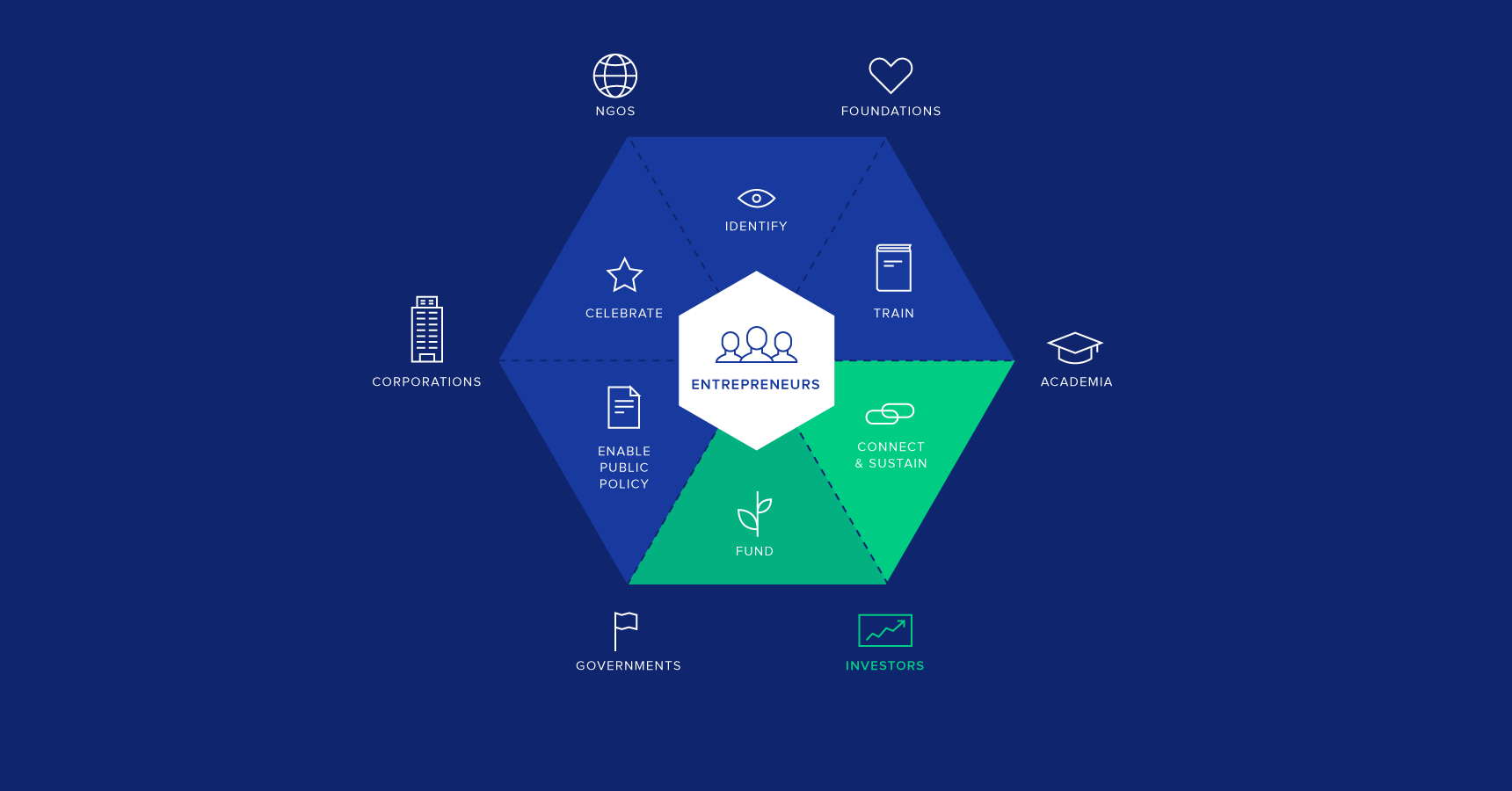

ICOs, Exotics, and Platforms: An Insider’s Perspective on the Future of Venture Capital

2017 saw a number of issues arise in the VC industry and it may be approaching a watershed regarding its relevance.

This article looks into the root causes of the industry’s problems and why they have come to light. VCs can go through a pivot of their own to retain a seat at the table, with big data, exotic funds and platforms offering a path forward.

Toptal Talent Network Experts

Exploring the Bear Case of the Cryptocurrency Bubble

The arguments for a cryptocurrency revolution can tend to sway toward appearing more like get-rich-quick schemes than balanced debates. The regulatory risk overhang, constant scams, and technological immaturity of the movement mean that long-term success is far from certain.

In this article, Jonathan Sterling addresses the other side of the argument: the bear case for a crypto future. He shines a light on the problems blighting cryptocurrencies and some remedies for them, drawing upon comparisons with historic bubbles, some centuries old.

Jonathan Sterling

World-class articles, delivered weekly.

Toptal Finance Experts

- Blockchain Consultants

- Business Management Consultants

- Business Plan Consultants

- Business Process Optimization Consultants

- Certified Public Accountants (CPA)

- Economic Development Consultants

- Equity Research Analysts

- Excel Experts

- Financial Benchmarking Consultants

- Financial Forecasting Experts

- Financial Modeling Consultants

- Financial Writers

- Fintech Consultants

- FP&A Managers

- Fractional CFOs

- Fundraising Consultants

- FX Consultants

- Growth Strategy Consultants

- Integrated Business Planning Consultants

- Interim CFOs

- Investment Managers

- Investment Thesis Consultants

- Investor Relations Consultants

- M&A Consultants

- Market Sizing Experts

- Pitch Deck Consultants

- Private Equity Consultants

- Procurement Consultants

- Profitability Analysis Experts

- Real Estate Experts

- Restructuring Consultants

- Risk Management Consultants

- Small Business Consultants

- Supply Chain Management Consultants

- Valuation Specialists

- Venture Capital Consultants

- Virtual CFOs

- Xero Experts

- View More Freelance Finance Experts

Join the Toptal® community.